Essay

Part

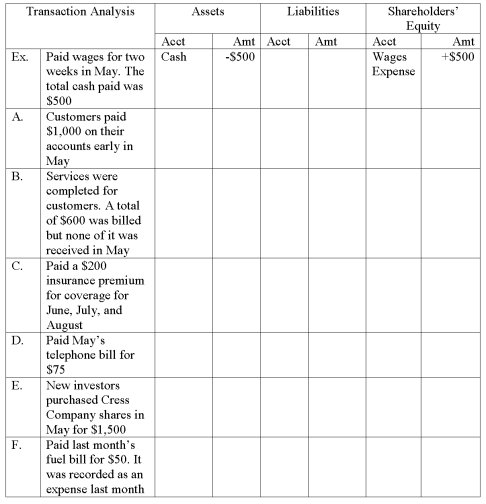

A.Perform transaction analysis for Cress Company regarding the following transactions for May.Indicate an increase (+)or decrease (-)to the account in front of the amount.

Part

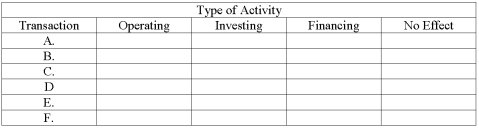

B.Determine whether the transactions (A)-(F)above affected cash flows.If so,determine the type of activity as an operating activity,an investing activity,or a financing activity.If cash is not affected use "no effect." Place a check mark under the appropriate column for each transaction

Correct Answer:

Verified

Correct Answer:

Verified

Q29: Revenue is always recognized when which of

Q60: Which of the following activities will most

Q61: Explain why the profit reported on the

Q62: The category that is generally considered to

Q63: When a corporation pays a dividend,the<br>A)expense account

Q64: On December 31,20A,Ted Corporation paid $2,000 for

Q66: Expenses incurred but not paid decrease assets

Q68: A company reports sales revenue of $120

Q70: Under the accrual basis of accounting<br>A)cash must

Q88: Revenue accounts normally have debit balances because