Multiple Choice

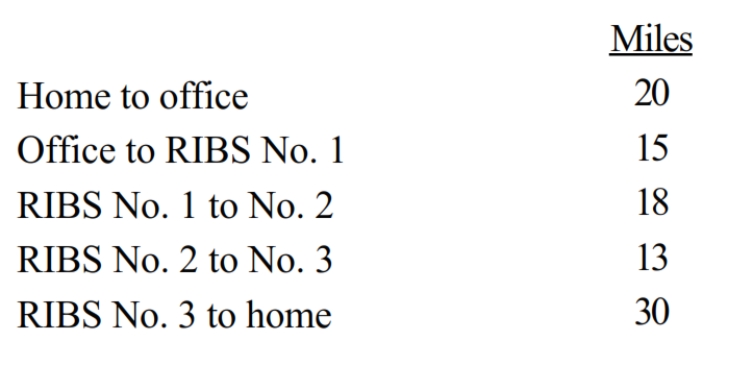

Corey is the city sales manager for "RIBS," a national fast food franchise. Every working day, Corey drives his car as follows:

Corey renders an adequate accounting to his employer. As a result, Corey's reimburseable mileage is:

A) 0 miles.

B) 50 miles.

C) 66 miles.

D) 76 miles.

E) None of these.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Eileen lives and works in Mobile.She travels

Q74: Allowing for the overall limitation (50% reduction

Q75: Dana, age 31 and unmarried, is an

Q76: Sue performs services for Lynn. Regarding this

Q77: Aiden performs services for Lucas. Which, if

Q79: Sue performs services for Lynn. Regarding this

Q81: An education expense deduction may be allowed

Q81: Which, if any, of the following expenses

Q82: For tax year 2018, Taylor used the

Q83: Travel status requires that the taxpayer be