Essay

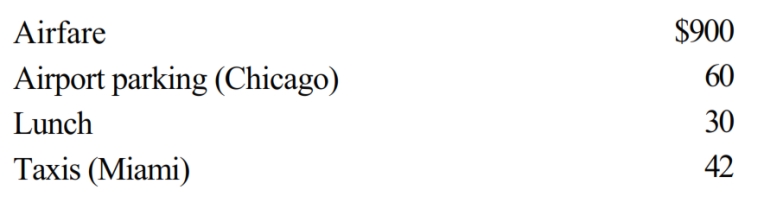

Alfredo, a self-employed patent attorney, flew from his home in Chicago to Miami, had lunch alone at the airport, conducted business in the afternoon, and returned to Chicago in the evening. His expenses were as follows:

What is Alfredo's deductible expense for the trip?

Correct Answer:

Verified

$1,002 ($900 + $60 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q49: Statutory employees:<br>A)Report their expenses as miscellaneous itemized

Q53: Sue performs services for Lynn. Regarding this

Q54: Lily (self-employed) went from her office in

Q56: Jordan performs services for Ryan. Which, if

Q57: During the year, John (a self-employed management

Q59: Which of the following would constitute an

Q60: If a married taxpayer is an active

Q61: Flamingo Corporation furnishes meals at cost to

Q62: On February 1, 2018, Tuan withdrew $15,000

Q63: In which, if any, of the following