Essay

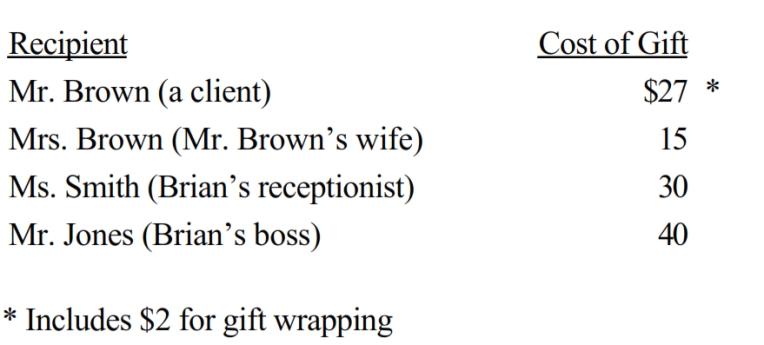

Brian makes gifts as follows:

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Correct Answer:

Verified

$52 ($27 + $25). The deduction for Mr. B...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$52 ($27 + $25). The deduction for Mr. B...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q14: Ethan, a bachelor with no immediate family,

Q16: In terms of income tax treatment, what

Q17: A taxpayer who maintains an office in

Q20: Merrill is a participant in a SIMPLE

Q23: Sammy, age 31, is unmarried and is

Q24: A participant who is at least age

Q24: In the case of an office in

Q40: A worker may prefer to be treated

Q48: Which of the following expenses, if any,

Q67: For the spousal IRA provision to apply,