Multiple Choice

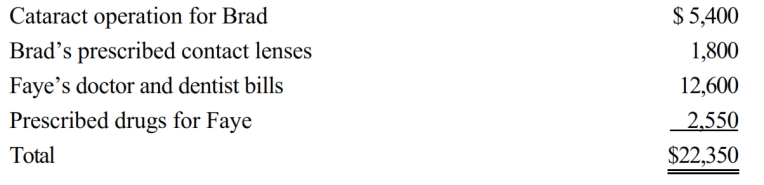

Brad, who would otherwise qualify as Faye's dependent, had gross income of $9,000 during the year. Faye, who had AGI of $120,000, paid the following medical expenses this year:

Faye has a medical expense deduction of:

A) $3,150

B) $4,950

C) $10,350

D) $13,350

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q40: This year Allison drove 800 miles to

Q42: Maria traveled to Rochester, Minnesota, with her

Q43: For all of the current year, Randy

Q44: Harry and Sally were divorced three years

Q48: Judy paid $40 for Girl Scout cookies

Q49: Tom, age 48, is advised by his

Q50: Interest paid or accrued during 2018 on

Q53: Pedro's child attends a school operated by

Q54: Capital assets donated to a public charity

Q89: Excess charitable contributions that come under the