Multiple Choice

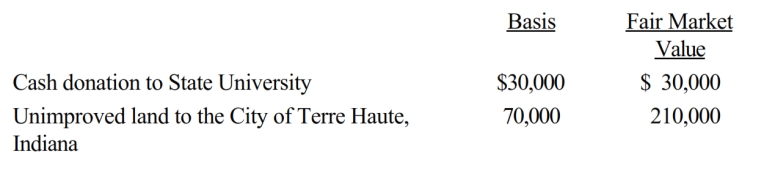

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:

The land had been held as an investment and was acquired 4 years ago. Shortly after receipt, the City of Terre Haute sold the land for $210,000. Karen's AGI is $450,000. The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Shirley pays FICA (employer's share) on the

Q10: The election to itemize is appropriate when

Q30: In Piatt County, the real property tax

Q31: Matt, a calendar year taxpayer, pays $11,000

Q34: Samuel, a 36 year old individual who

Q35: Barry and Larry, who are brothers, are

Q36: Hannah makes the following charitable donations in

Q37: During the year, Eve (a resident of

Q48: Jack sold a personal residence to Steven

Q88: For purposes of computing the deduction for