Essay

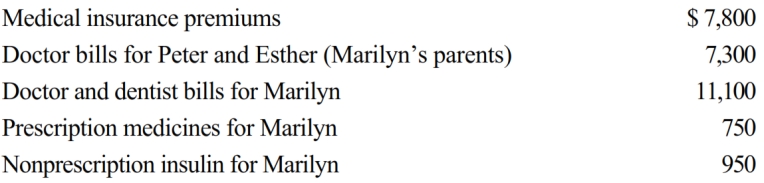

Marilyn, age 38, is employed as an architect. For calendar year 2018, she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return. Marilyn's medical insurance policy does not cover them. Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2018 and received the reimbursement in January 2019. What is Marilyn's maximum allowable medical expense deduction for 2018?

Correct Answer:

Verified

Marilyn's medical expense deduction is $...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A physician recommends a private school for

Q29: For purposes of computing the deduction for

Q35: On December 31, Lynette used her credit

Q60: Points paid by the owner of a

Q70: Joe, a cash basis taxpayer, took out

Q73: Which of the following is not allowed

Q76: Byron owned stock in Blossom Corporation that

Q77: In January 2019, Pam, a calendar year

Q79: Adrienne sustained serious facial injuries in a

Q81: Leona borrows $100,000 from First National Bank