Short Answer

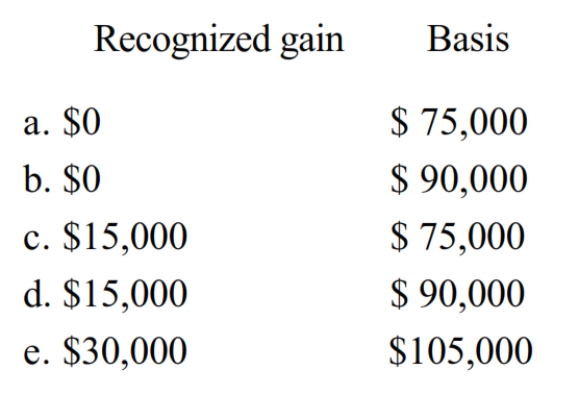

Nat is a salesman for a real estate developer. His employer permits him to purchase a lot for $75,000. The employer's adjusted basis for the lot is $45,000, and its normal selling price is $90,000. What is Nat's recognized gain and his basis for the lot?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Under what circumstances may a partial §

Q49: Under what circumstance is there recognition of

Q102: The carryover basis to a donee for

Q158: Nancy gives her niece a crane to

Q161: Which of the following is correct?<br>A) The

Q162: Libby's principal residence is destroyed by a

Q164: Melody's adjusted basis for 10,000 shares of

Q166: Terry exchanges real estate (acquired on August

Q167: Define fair market value as it relates

Q168: During 2018, Howard and Mabel, a married