Multiple Choice

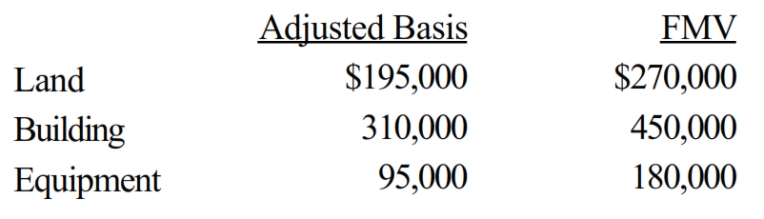

Mona purchased a business from Judah for $1,000,000. Judah's records and an appraiser provided her with the following information regarding the assets purchased:

What is Mona's adjusted basis for the land, building, and equipment?

A) Land $270,000, building $450,000, equipment $180,000.

B) Land $195,000, building $575,000, equipment $230,000.

C) Land $195,000, building $310,000, equipment $95,000.

D) Land $270,000, building $521,429, equipment $208,571.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: In a deductible casualty or theft, the

Q28: A realized gain whose recognition is postponed

Q30: On October 1, Paula exchanged an apartment

Q32: Which of the following statements is false?<br>A)

Q38: Alice owns land with an adjusted basis

Q40: Alice owns land with an adjusted basis

Q55: The basis for gain and loss of

Q57: Lump-sum purchases of land and a building

Q73: Why is it generally undesirable to pass

Q217: Discuss the effect of a liability assumption