Short Answer

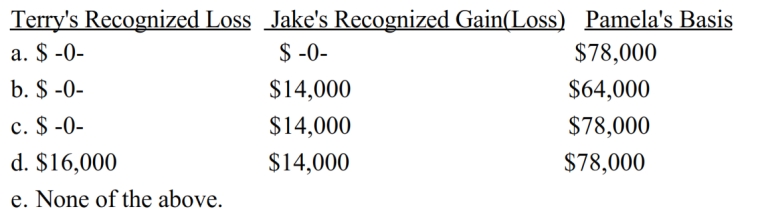

Terry owns Lakeside, Inc. stock (adjusted basis of $80,000), which she sells to her brother, Jake, for $64,000 (its fair market value). Eighteen months later, Jake sells the stock to Pamela, a friend, for $78,000 (its fair market value). What is Terry's recognized loss, Jake's recognized gain or loss, and Pamela's adjusted basis for the stock?

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Taylor inherited 100 acres of land on

Q3: Samuel's hotel is condemned by the City

Q4: Neal and his wife Faye reside in

Q6: What effect do the assumption of liabilities

Q7: Kevin purchased 5,000 shares of Purple Corporation

Q8: During 2018, Ted and Judy, a married

Q9: Ed and Cheryl have been married for

Q10: Melissa, age 58, marries Arnold, age 50,

Q47: Milton purchases land and a factory building

Q156: What requirements must be satisfied to receive