Essay

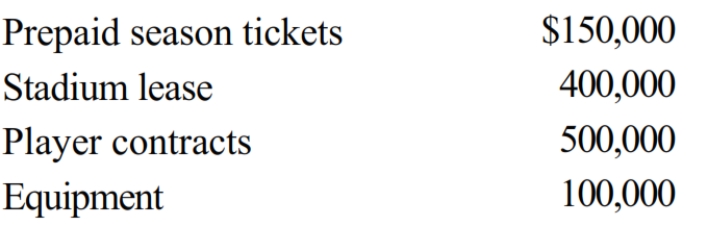

Marge purchases the Kentwood Krackers, a AAA level baseball team, for $1.5 million. The appraised values of the identified assets are as follows:

The Krackers have won the pennant for the past two years. Determine Marge's adjusted basis for the assets of the Kentwood Krackers.

Correct Answer:

Verified

The portion of the purchase pr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: In computing the amount realized when the

Q45: If the fair market value of the

Q58: A loss from the sale of a

Q85: For nontaxable stock rights where the fair

Q142: Monica sells a parcel of land to

Q143: Jan purchases taxable bonds with a face

Q148: Albert purchased a tract of land for

Q150: Patty's factory building, which has an adjusted

Q151: For disallowed losses on related-party transactions, who

Q152: Hubert purchases Fran's jewelry store for $950,000.