Essay

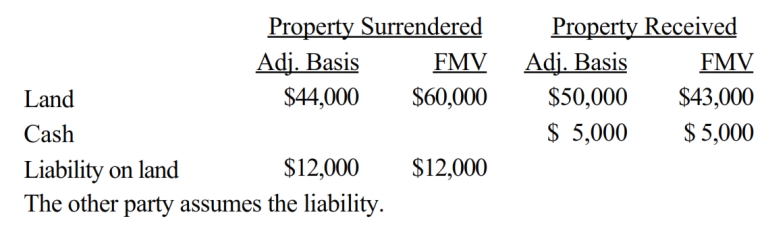

Sammy exchanges land used in his business in a like-kind exchange. The property exchanged is as follows:

a. What is Sammy's recognized gain or loss?

b. What is Sammy's basis for the assets he received?

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q54: Ken is considering two options for selling

Q67: If a taxpayer purchases taxable bonds at

Q74: The wash sales rules apply to both

Q96: Edward, age 52, leased a house for

Q232: Over the past 20 years, Alfred has

Q235: The amount of a corporate distribution qualifying

Q236: For the following exchanges, indicate which qualify

Q239: How is the donee's basis calculated for

Q241: Bud exchanges land with an adjusted basis

Q242: Which of the following statements is correct