Essay

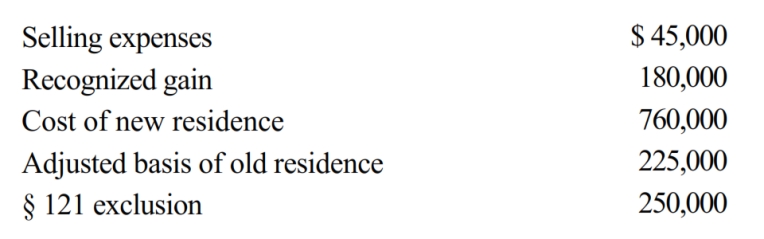

Use the following data to determine the sales price of Etta's principal residence and the realized gain. She is not married. The sale of the old residence qualifies for the § 121 exclusion.

Correct Answer:

Verified

The sale of residence model can be used ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: A strip along the boundary of Joy's

Q18: Weston sells his residence to Joanne on

Q20: A factory building owned by Amber, Inc.

Q24: Lynn purchases a house for $52,000. She

Q25: Kendra owns a home in Atlanta. Her

Q26: To qualify for the § 121 exclusion,

Q51: Purchased goodwill is assigned a basis equal

Q68: The exchange of unimproved real property located

Q129: Discuss the treatment of realized gains from

Q206: Discuss the relationship between the postponement of