Multiple Choice

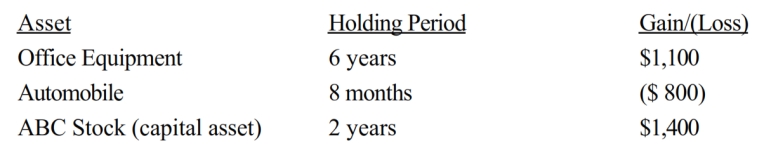

The following assets in Jack's business were sold in 2018:

The office equipment had a zero adjusted basis and was purchased for $8,000. The automobile was purchased for $2,000 and sold for $1,200. The ABC stock was purchased for $1,800 and sold for $3,200. In 2018 (the year of sale) , Jack should report what amount of net capital gain and net ordinary income?

A) $1,700 LTCG.

B) $600 LTCG and $300 ordinary gain.

C) $1,400 LTCG and $300 ordinary gain.

D) $2,500 LTCG and $800 ordinary loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: An accrual basis taxpayer accepts a note

Q34: Since the Code section that defines capital

Q42: Involuntary conversion gains may be deferred if

Q45: Assume a building is subject to §

Q48: Sara is filing as head of household

Q51: Ramon is in the business of buying

Q52: Vertigo, Inc., has a 2018 net §

Q53: The maximum amount of the unrecaptured §

Q54: A net short-term capital loss first offsets

Q55: Lynne owns depreciable residential rental real estate