Essay

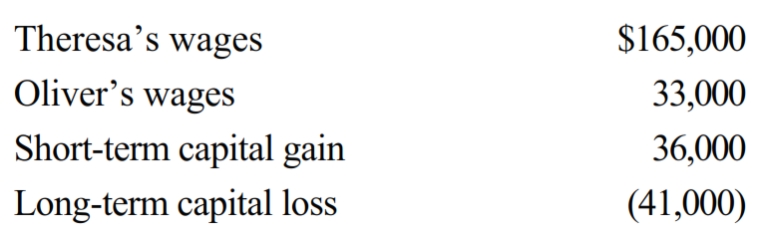

Theresa and Oliver, married filing jointly, and both over 65 years of age, have no dependents. Their 2018 income tax facts are:

What is their taxable income for 2018?

Correct Answer:

Verified

The couple's taxable income is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The maximum § 1245 depreciation recapture generally

Q32: A franchisor licenses its mode of business

Q69: A corporation has a $50,000 short-term capital

Q136: Charmine, a single taxpayer with no dependents,

Q139: The tax law requires that capital gains

Q140: Sharon has the following results of netting

Q142: Janet received stock worth $4,000 at the

Q143: When a patent is transferred, the most

Q145: Ryan has the following capital gains and

Q146: Violet, Inc., has a 2018 $80,000 long-term