Essay

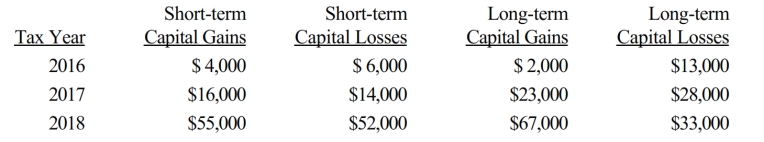

The chart below details Sheen's 2016, 2017, and 2018 stock transactions. What is the capital loss carryover to 2018 and what is the net capital gain or loss for 2018?

Correct Answer:

Verified

The 2017 capital loss carryforward is $1...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Thoren has the following items for the

Q11: A business taxpayer sells inventory for $80,000.

Q12: Which of the following would extinguish the

Q13: Orange Company had machinery destroyed by a

Q14: Which of the following events causes the

Q17: Martha has both long-term and short-term 2018

Q18: Martha is unmarried with one dependent and

Q19: Which of the following events could result

Q20: In 2018, Mark has $18,000 short-term capital

Q43: Section 1245 depreciation recapture potential does not