Essay

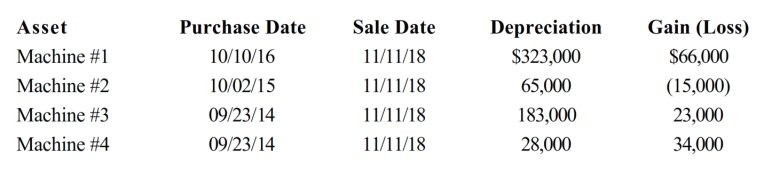

A business taxpayer sold all the depreciable assets of the business, calculated the gains and losses, and would like to know the final character of those gains and losses. The taxpayer had $353,000 of adjusted gross income before considering the gains and losses from sale of the business assets. The taxpayer had unrecaptured § 1231 lookback loss of $22,000. What is the treatment of the gains and losses summarized in the chart below after all possible netting and reclassification has been completed? What is the taxpayer's adjusted gross income? (Ignore the self- employment tax deduction.)

Correct Answer:

Verified

The taxpayer has adjusted gross income o...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: A sheep must be held more than

Q55: Section 1231 property generally includes certain purchased

Q68: The tax law requires that capital gains

Q85: Ranja acquires $200,000 face value corporate bonds

Q89: Recognized gains and losses from disposition of

Q90: Section 1231 property includes nonpersonal use property

Q92: The only things that the grantee of

Q94: Annabelle is a "trader" in securities. She

Q96: A worthless security had a holding period

Q97: Williams owned an office building (but not