Essay

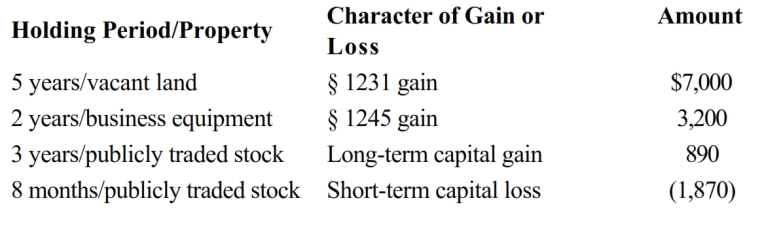

An individual taxpayer has the gains and losses shown below. There are $3,000 of § 1231 lookback losses. What is the net long-term capital gain?

Correct Answer:

Verified

The taxpayer has a net long-term capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The taxpayer has a net long-term capital...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q1: Describe the circumstances in which the potential

Q15: Section 1231 applies to the sale or

Q24: Rental use depreciable machinery held more than

Q30: A personal use property casualty loss that

Q48: Lease cancellation payments received by a lessor

Q52: Describe the circumstances in which the maximum

Q59: Why is it generally better to have

Q63: Section 1245 applies to amortizable § 197

Q112: In 2014, Aaron purchased a classic car

Q118: Stanley operates a restaurant as a sole