Essay

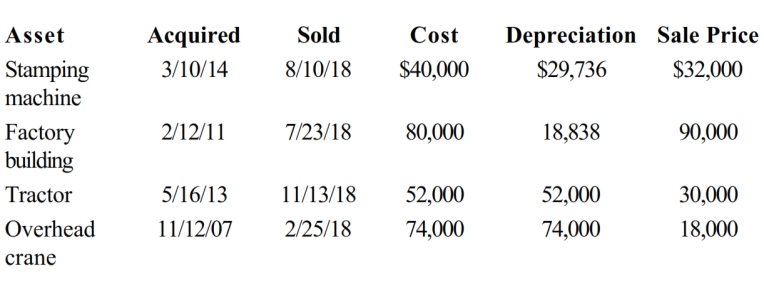

The chart below describes the § 1231 assets sold by the Ecru Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $4,000.

Correct Answer:

Verified

The stamping machine ($21,736), tractor ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Tan, Inc., sold a forklift on April

Q5: Verway, Inc., has a 2018 net §

Q7: A business taxpayer sells depreciable business property

Q10: Thoren has the following items for the

Q11: A business taxpayer sells inventory for $80,000.

Q12: Depreciation recapture under § 1245 and §

Q12: Which of the following would extinguish the

Q13: Orange Company had machinery destroyed by a

Q41: Personal use property casualty gains and losses

Q84: Hilda lent $2,000 to a close personal