Essay

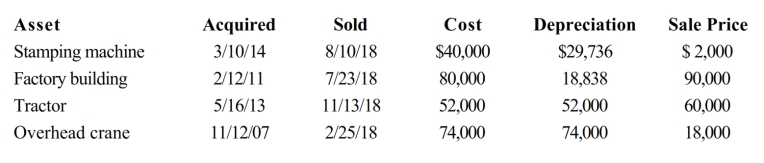

The chart below describes the § 1231 assets sold by the Tan Company (a sole proprietorship) this year. Compute the gain or loss from each asset disposition and determine the net § 1231 gain treated as long-term capital gain for the year. Assume there is a § 1231 lookback loss of $14,000.

Correct Answer:

Verified

The stamping machine is sold at a $8,264...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Section 1231 property generally does not include

Q31: Nonrecaptured § 1231 losses from the six

Q152: Individuals who are not professional real estate

Q154: In 2018, Satesh has $5,000 short-term capital

Q155: Robin Corporation has ordinary income from operations

Q157: Willie is the owner of vacant land

Q158: In 2017, Jenny had a $12,000 net

Q159: An individual taxpayer has a $2,500 short-term

Q160: Section 1239 (relating to the sale of

Q161: A business machine purchased April 10, 2016,