Essay

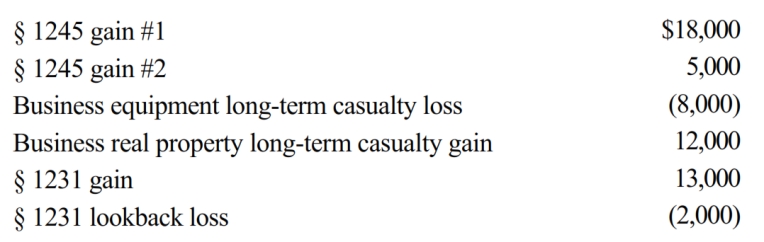

Betty, a single taxpayer with no dependents, has the gains and losses shown below. Before considering these transactions, Betty has $45,000 of other taxable income. What is the treatment of the gains and losses and what is Betty's taxable income?

Correct Answer:

Verified

The § 1245 recapture gains are combined ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Carol had the following transactions during 2018:

Q25: Hank inherited Green stock from his mother

Q26: Judith (now 37 years old) owns a

Q29: Jillian, a single taxpayer, has a net

Q30: Residential real estate was purchased in 2015

Q31: Gold Company signs a 13-year franchise agreement

Q32: The possible holding periods for capital assets

Q56: Once § 1231 gains are netted against

Q71: Short-term capital gain is eligible for a

Q74: Confusingly, §1221 defines what is not a