Essay

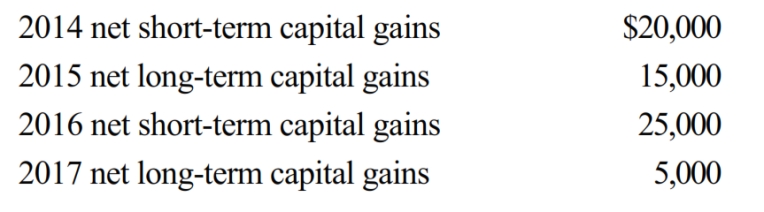

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2018. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2018 tax return?

b. Determine the amount of the 2018 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2018 tax return?

Correct Answer:

Verified

a.

The net capital loss of $70,000 is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The net capital loss of $70,000 is...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: In tax planning for charitable contributions, a

Q20: Wanda is the Chief Executive Officer of

Q20: An expense that is deducted in computing

Q21: During the current year, Jay Corporation, a

Q23: During the current year, Violet, Inc., a

Q26: Orange Corporation, a calendar year C corporation,

Q28: Thrush Corporation, a calendar year C corporation,

Q47: Explain the rules regarding the accounting periods

Q67: How is the limitation on the deduction

Q73: The accumulated earnings and personal holding company