Multiple Choice

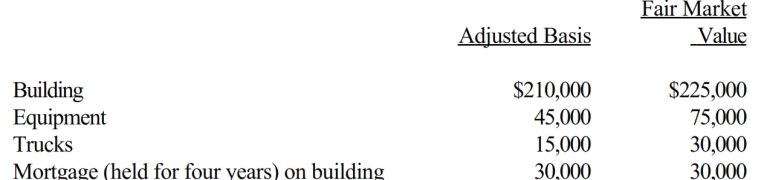

Rick transferred the following assets and liabilities to Warbler Corporation.

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding (fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Rita forms Finch Corporation by transferring land

Q31: Carl and Ben form Eagle Corporation. Carl

Q37: Ruth transfers property worth $200,000 (basis of

Q72: The transfer of an installment obligation in

Q83: Adam transfers cash of $300,000 and land

Q84: Earl and Mary form Crow Corporation. Earl

Q85: Rachel owns 100% of the stock of

Q85: For § 351 purposes, stock rights and

Q89: George transfers cash of $150,000 to Finch

Q91: Four individuals form Chickadee Corporation under §