Essay

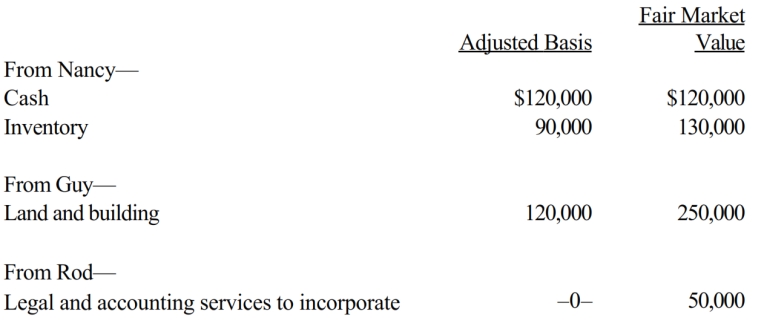

Nancy, Guy, and Rod form Goldfinch Corporation with the following consideration.

Goldfinch issues its 500 shares of stock as follows: 250 to Nancy, 200 to Guy, and 50 to Rod. In addition, Guy gets $50,000 in cash.

a. Does Nancy, Guy, or Rod recognize gain (or income)?

b. What basis does Guy have in the Goldfinch stock?

c. What basis does Goldfinch Corporation have in the inventory? In the land and building?

d. What basis does Rod have in the Goldfinch stock?

Correct Answer:

Verified

a. Nancy recognizes no gain. Due to the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: When a taxpayer transfers property subject to

Q50: Jane transfers property (basis of $180,000 and

Q53: Eve transfers property (basis of $120,000 and

Q56: Mitchell and Powell form Green Corporation. Mitchell

Q57: Dawn, a sole proprietor, was engaged in

Q58: Jane and Walt form Yellow Corporation. Jane

Q58: Because services are not considered property under

Q60: When depreciable property is transferred to a

Q77: Penny, Miesha, and Sabrina transfer property to

Q82: A shareholder lends money to his corporation