Multiple Choice

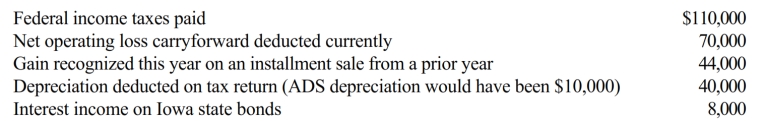

Rose Corporation (a calendar year taxpayer) has taxable income of $300,000, and its financial records reflect the following for the year.

Rose Corporation's current E & P is:

A) $254,000.

B) $214,000.

C) $194,000.

D) $104,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: How does the definition of accumulated E

Q52: Ten years ago, Carrie purchased 2,000 shares

Q53: Brett owns stock in Oriole Corporation (basis

Q56: A distribution from a corporation will be

Q58: Which of the following is a correct

Q59: Pheasant Corporation, a calendar year taxpayer, has

Q60: Albatross Corporation acquired land for investment purposes

Q61: Tangelo Corporation has an August 31 year-end.

Q68: Finch Corporation (E & P of $400,000)

Q183: Property distributed by a corporation as a