Multiple Choice

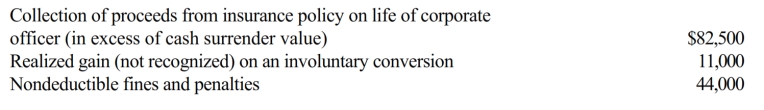

Silver Corporation, a calendar year taxpayer, has taxable income of $550,000. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

A) $500,500.

B) $588,500.

C) $599,500.

D) $687,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Briefly describe the reason a corporation might

Q42: When computing current E & P, taxable

Q58: Corporate shareholders generally receive less favorable tax

Q73: A deficit in current E & P

Q77: Using the legend provided, classify each statement

Q80: Christian, the president and sole shareholder of

Q85: Tracy and Lance, equal shareholders in Macaw

Q87: Hawk Corporation has 2,000 shares of stock

Q124: Using the legend provided, classify each statement

Q145: To determine current E & P, taxable