Multiple Choice

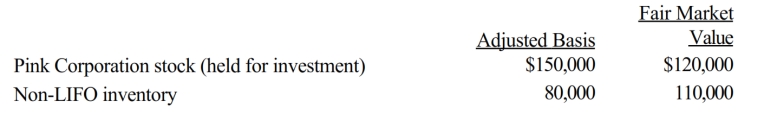

In the current year, Warbler Corporation (E & P of $250,000) made the following property distributions to its shareholders (all corporations) :

Warbler Corporation is not a member of a controlled group. As a result of the distribution:

A) The shareholders have dividend income of $200,000.

B) The shareholders have dividend income of $260,000.

C) Warbler has a recognized gain of $30,000 and a recognized loss of $30,000.

D) Warbler has no recognized gain or loss.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: No E & P adjustment is required

Q37: Using the legend provided, classify each statement

Q44: Raul's gross estate includes 1,500 shares of

Q46: On January 1, Tulip Corporation (a calendar

Q52: Ten years ago, Carrie purchased 2,000 shares

Q53: Brett owns stock in Oriole Corporation (basis

Q54: Briefly discuss the rules related to distributions

Q56: A distribution from a corporation will be

Q77: For purposes of a partial liquidation, the

Q79: Use of MACRS cost recovery when computing