Essay

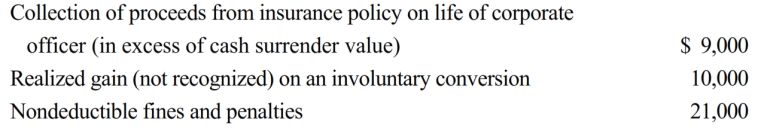

Kite Corporation, a calendar year taxpayer, has taxable income of $360,000 for 2019. Among its transactions for the year are the following:

Disregarding any provision for Federal income taxes, determine Kite Corporation's current E & P for 2019.

Correct Answer:

Verified

The realized gain ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

The realized gain ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Robin Corporation distributes furniture (basis of $40,000?

Q10: Tungsten Corporation, a calendar year cash basis

Q11: Lucinda owns 1,100 shares of Blackbird Corporation

Q13: Which of the following statements is correct

Q15: Purple Corporation makes a property distribution to

Q17: At the beginning of the current year,

Q18: Steve has a capital loss carryover in

Q19: Falcon Corporation ended its first year of

Q114: Under certain circumstances, a distribution can generate

Q131: If a distribution of stock rights is