Essay

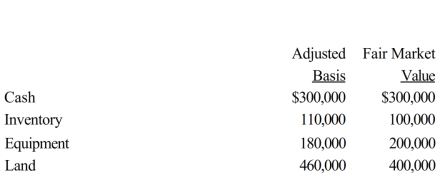

The stock in Crimson Corporation is owned by Angel and Melawi, who are unrelated. Angel owns 60% and Melawi owns 40% of the stock. All of Crimson Corporation's assets were acquired by purchase. The following assets are to be distributed in complete liquidation of Crimson Corporation:

a. What gain or loss, if any, would Crimson Corporation recognize if it distributes the cash, inventory, and equipment to Angel and the land to Melawi?

b. What gain or loss, if any, would Crimson Corporation recognize if it distributes the equipment and land to Angel and the cash and inventory to Melawi?

Correct Answer:

Verified

a. With respect to the distributions to ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Do noncorporate and corporate shareholders typically have

Q53: The rules used to determine the taxability

Q64: Constructive dividends do not need to satisfy

Q69: Corporate distributions are presumed to be paid

Q81: Gold Corporation has accumulated E & P

Q93: Maria and Christopher each own 50% of

Q95: Thistle Corporation declares a nontaxable dividend payable

Q98: Using the legend provided, classify each statement

Q144: In a property distribution, the amount of

Q149: If there is sufficient E & P,