Essay

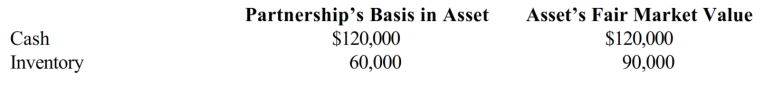

Randy owns a one-fourth capital and profits interest in the calendar-year RUSR Partnership. His adjusted basis for his partnership interest was $200,000 when he received a proportionate nonliquidating distribution of the following assets.

a. Calculate Randy's recognized gain or loss on the distribution, if any. Explain.

b. Calculate Randy's basis in the inventory received.

c. Calculate Randy's basis for his partnership interest after the distribution.

Correct Answer:

Verified

a. Randy recognizes no gain or loss. As ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Match each of the following statements with

Q135: A cash distribution from a partnership to

Q137: In which of the following independent situations

Q139: Tara and Robert formed the TR Partnership

Q140: Match each of the following statements with

Q141: The RGBY LLC operating agreement provides that

Q142: ABC, LLC is equally-owned by three corporations.

Q145: Kristie is a 30% partner in the

Q193: Paul sells one parcel of land (basis

Q204: Sharon and Sue are equal partners in