Essay

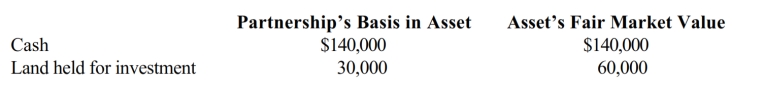

Connie owns a one-third capital and profits interest in the calendar-year CDB Partnership. Her adjusted basis for her partnership interest was $120,000 when she received a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Connie's recognized gain or loss on the distribution, if any.

b. Calculate Connie's basis in the land received.

c. Calculate Connie's basis for her partnership interest after the distribution.

Correct Answer:

Verified

a. $20,000 gain. Connie recognizes a gai...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Tim, Al, and Pat contributed assets to

Q9: A partnership deducts all of its interest

Q10: PaulCo, DavidCo, and Sean form a partnership

Q12: In the current year, Derek formed an

Q15: Julie and Kate form an equal partnership

Q26: The partnership agreement might provide, for example,

Q31: Serena owns a 40% interest in the

Q60: George received a fully vested 10% interest

Q94: Which of the following statements is correct

Q174: The taxable income of a partnership flows