Essay

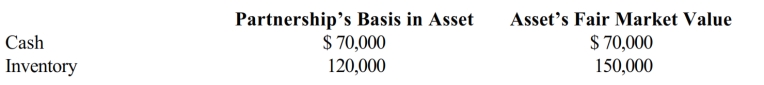

Josh has a 25% capital and profits interest in the calendar-year GDJ Partnership. His adjusted basis for his partnership interest on October 15 of the current year is $300,000. On that date, the partnership liquidates and makes a proportionate distribution of the following assets to Josh.

a. Calculate Josh's recognized gain or loss on the liquidating distribution, if any, and his basis in the distributed inventory.

How would your answer to

a. change if the partnership also distributed a small parcel of land it

b. had held for investment to Josh? Assume the land has a $5,000 adjusted basis (FMV is $8,000) to the partnership.

Correct Answer:

Verified

a. Josh takes a carryover basis of $120,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q37: Match each of the following statements with

Q40: The BMR LLC conducted activities that were

Q155: Maria owns a 60% interest in the

Q157: AmCo and BamCo form the AB General

Q158: Katherine invested $80,000 this year to purchase

Q159: A partnership will take a carryover basis

Q162: Steve's basis in his SAW Partnership interest

Q164: Which one of the following is not

Q165: In the current year, the POD Partnership

Q207: Match each of the following statements with