Essay

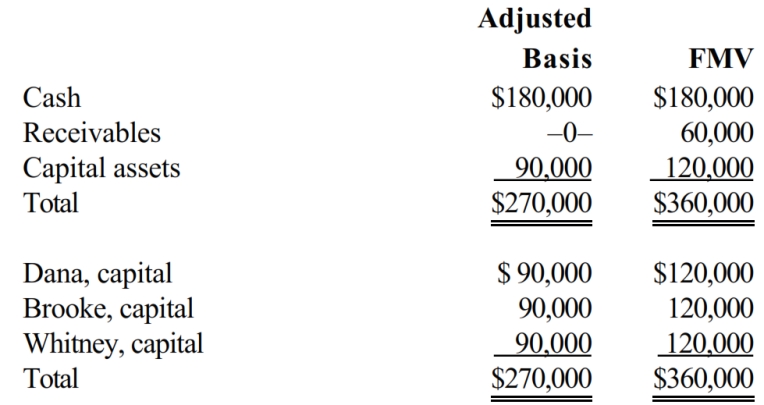

The December 31, balance sheet of DBW, LLP, a service-providing partnership, is as follows.

The partners share equally in partnership capital, income, gain, loss, deduction, and credit. Capital is not a material income-producing factor to the partnership. On December 31, partner Dana (who is an active managing partner in the partnership) receives a distribution of $120,000 cash in liquidation of her partnership interest under § 736. Dana's outside basis for the partnership interest immediately before the distribution is $90,000. How much is Dana's gain or loss on the distribution and what is its character?

Correct Answer:

Verified

$20,000 ordinary income and $10,000 capi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q85: Laura is a real estate developer and

Q103: Brooke and John formed a partnership. Brooke

Q104: Samuel is the managing general partner of

Q105: The total tax burden on entity income

Q108: Which of the following statements is always

Q109: Match each of the following statements with

Q110: Janella's basis in her partnership interest was

Q112: BRW Partnership reported gross income from operations

Q214: Match each of the following statements with

Q226: On the formation of a partnership, when