Multiple Choice

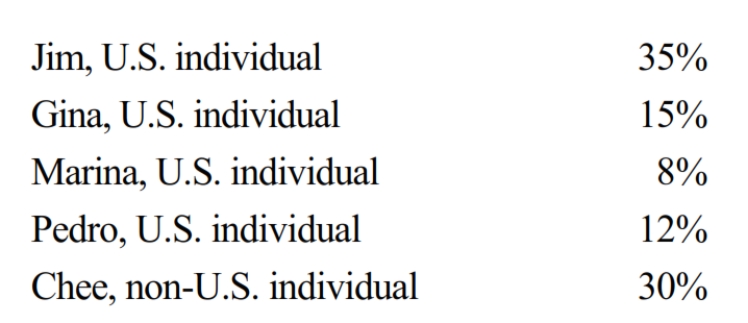

The following persons own Schlecht Corporation, a non-U.S.entity.

None of the shareholders are related. Subpart F income for the tax year is $300,000. No distributions are made. Which of the following statements is correct?

A) Schlecht is not a CFC.

B) Chee includes $90,000 in gross income.

C) Marina is not a U.S. shareholder for purposes of determining whether Schlecht is a CFC.

D) Marina includes $24,000 in gross income.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Match the definition with the correct term.<br>-A

Q17: Gains on the sale of U.S. real

Q47: Which of the following statements regarding a

Q50: Unused foreign tax credits are carried back

Q54: The IRS can use § 482 reallocations

Q57: Luisa, a non-U.S. person with a green

Q59: ForCo, a non-U.S. corporation based in Aldonza,

Q85: Which of the following statements regarding a

Q94: Match the definition with the correct term.<br>-Treasury

Q108: In which of the following independent situations