Essay

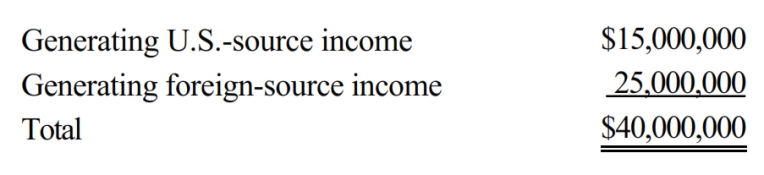

Goolsbee, Inc., a U.S. corporation, generates U.S.-source and foreign-source gross income. Goolsbee's assets (tax basis) are as follows.

Goolsbee incurs interest expense of $200,000. Apportion interest expense to foreign-source income.

Correct Answer:

Verified

Correct Answer:

Verified

Q21: ForCo, a foreign corporation, receives interest income

Q24: Match the definition with the correct term.<br>-Individual

Q45: Yvonne is a citizen of France and

Q47: In working with the foreign tax credit,

Q73: A domestic corporation is one whose assets

Q74: Which of the following determinations requires knowing

Q75: A deferral of Federal corporate income taxes

Q78: Section 482 is used by the Treasury

Q81: To reduce current income taxation, a U.S.

Q82: Jaime received gross foreign-source dividend income of