Multiple Choice

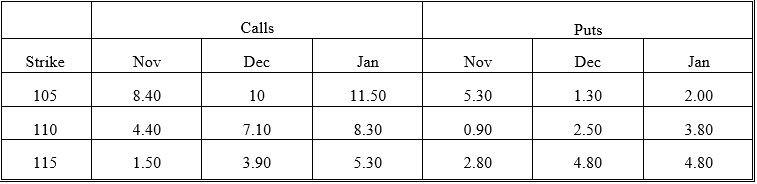

The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions 7 through 20.

The stock price was 113.25. The risk-free rates were 7.30 percent (November) , 7.50 percent (December) and 7.62 percent (January) . The times to expiration were 0.0384 (November) , 0.1342 (December) , and 0.211 (January) . Assume no dividends unless indicated.

-Suppose you knew that the January 115 options were correctly priced but suspected that the stock was mispriced.Using put-call parity,what would you expect the stock price to be? For this problem,treat the options as if they were European.

A) 113.73

B) 123.23

C) 121.23

D) 112.77

E) none of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q5: An American call should be exercised early

Q6: Holding everything else constant,a longer-term European put

Q7: At expiration the call price must converge

Q8: An option can be priced at less

Q9: The difference between an American call's price

Q11: The lower the exercise price,the more valuable

Q12: The following quotes were observed for options

Q13: On March 2,a Treasury bill expiring on

Q14: What is the lowest possible value of

Q15: If one portfolio always provides a return