Essay

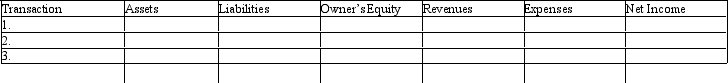

Each of the following transactions for Morrison Company requires an adjusting entry, which if omitted, will overstate or understate assets, liabilities, owner's equity, revenues, expenses, or net income. Indicate the amount and direction of the misstatement that would result if the end of period adjusting entry suggested by the transaction was omitted. Place your results in the table following the transactions and use (+) for overstate, (-) for understate, and (NE) for no effect.

1. Morrison purchased supplies on December 1 for $900. On December 31, $350 of supplies were on hand.

2. Prepaid insurance had a debit balance of $5,400 on December 1, which represented a prepayment for 2 years of insurance.

3. The unearned rent revenue account has a credit balance of $390 on December 1, which represents 3 months rent.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: A fiscal year that ends when business

Q90: Accrued expenses are ordinarily listed on the

Q138: The Balance Sheet should be prepared<br>A) before

Q161: The following revenue and expense account balances

Q161: The following are steps in the accounting

Q164: The worksheet<br>A) is an integral part of

Q164: You have just accepted your first job

Q165: Bob Evans owns a business, Beachside Realty,

Q170: Prepaid insurance is reported on the balance

Q199: All income statement accounts will be closed