Essay

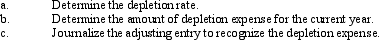

Solare Company acquired mineral rights for $60,000,000. The diamond deposit is estimated at 6,000,000 tons. During the current year, 2,300,000 tons were mined and sold.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: When a plant asset is traded for

Q13: XYZ Co. incurred the following below costs

Q24: The most widely used depreciation method is<br>A)

Q37: Long-lived assets that are intangible in nature,

Q63: Accumulated Depreciation<br>A) is used to show the

Q68: Expected useful life is<br>A) calculated when the

Q84: Which of the following below is an

Q168: A fixed asset's estimated value at the

Q174: Regardless of the depreciation method, the amount

Q183: The cost of new equipment is called