Essay

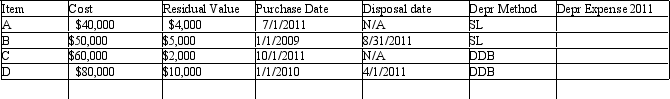

For each of the following fixed assets, determine the depreciation expense and the book value for the dates requested:

Disposal date is N/A if asset is still in use.

Method: SL = Straight Line; DDB = Double Declining Balance

Assume the estimated life was 5 years for each asset.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On June 1, 2014, Aaron Company purchased

Q14: On July 1st, Hartford Construction purchases a

Q46: The Bacon Company acquired new machinery with

Q51: On June 1, 2014, Aaron Company purchased

Q101: When old equipment is traded in for

Q107: To a major resort, timeshare properties would

Q113: Expenditures that increase operating efficiency or capacity

Q115: Computer equipment was acquired at the beginning

Q155: A machine costing $85,000 with a 5-year

Q215: Functional depreciation occurs when a fixed asset