Essay

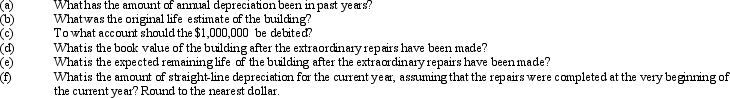

A number of major structural repairs completed at the beginning of the current fiscal year at a cost of $1,000,000 are expected to extend the life of a building 10 years beyond the original estimate. The original cost of the building was $6,552,000, and it has been depreciated by the straight-line method for 25 years. Estimated residual value is negligible and has been ignored. The related accumulated depreciation account after the depreciation adjustment at the end of the preceding fiscal year is $4,550,000.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The difference between the balance in a

Q9: The cost of computer equipment does include

Q11: When the amount of use of a

Q12: An asset was purchased for $58,000 and

Q20: Intangible assets differ from property, plant, and

Q65: The Weber Company purchased a mining site

Q65: Journalize each of the following transactions:<br> <img

Q100: Long-lived assets held for sale are classified

Q104: A capitalized asset will appear on the

Q139: Golden Sales has bought $135,000 in fixed