Essay

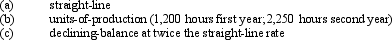

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of 5 years, or 14,000 operating hours, and a residual value of $10,000. Compute the depreciation for the first and second years of use by each of the following methods:

(Round the answer to the nearest dollar.)

(Round the answer to the nearest dollar.)

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: A machine with a cost of $75,000

Q28: Once the useful life of a depreciable

Q43: Which of the following is included in

Q51: When depreciation estimates are revised, all years

Q60: Determine the depreciation, for the year of

Q93: Select the following as a Fixed Asset

Q94: Macon Co. acquired drilling rights for $7,500,000.

Q101: What is the cost of the land,

Q140: An estimate of the amount which an

Q191: In a lease contract, the party who