Essay

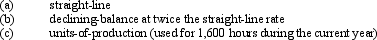

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(Round the answer to the nearest dollar.)

(Round the answer to the nearest dollar.)

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: The difference between the balance in a

Q12: An asset was purchased for $58,000 and

Q30: Ordinary gains from the sale of fixed

Q33: Falcon Company acquired an adjacent lot to

Q57: Machinery was purchased on January 1, 2010

Q98: Equipment with a cost of $220,000 has

Q104: A capitalized asset will appear on the

Q111: Copy equipment was acquired at the beginning

Q144: The double-declining-balance depreciation method calculates depreciation each

Q150: Computer equipment was acquired at the beginning