Essay

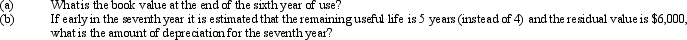

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for 6 years by the straight-line method. Assume a fiscal year ending December 31.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q10: The depreciable cost of a building is

Q48: A fixed asset with a cost of

Q69: When land is purchased to construct a

Q72: If a fixed asset with a book

Q73: Both the initial cost of the asset

Q93: A fixed asset with a cost of

Q103: Expenditures for research and development are generally

Q106: The process of transferring the cost of

Q136: When a company exchanges machinery and receives

Q158: A copy machine acquired on March 1,