Essay

On July 1st, Harding Construction purchases a bulldozer for $228,000. The equipment has a 8 year life with a residual value of $16,000. Harding uses straight-line depreciation.

(a) Calculate the depreciation expense and provide the journal entry for the first year ending December 31st.

(b) Calculate the third year's depreciation expense and provide the journal entry for the third year ending December 31st.

(c) Calculate the last year's depreciation expense and provide the journal entry for the last year.

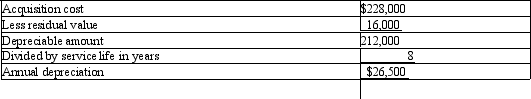

Annual depreciation is:

Correct Answer:

Verified

(a) First year depreciation is $26,500 ×...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: On December 31, Strike Company has decided

Q28: Once the useful life of a depreciable

Q43: Which of the following is included in

Q51: When depreciation estimates are revised, all years

Q101: What is the cost of the land,

Q109: Convert each of the following estimates of

Q134: When a company discards machinery that is

Q140: An estimate of the amount which an

Q146: A machine with a cost of $120,000

Q194: An exchange is said to have commercial