Essay

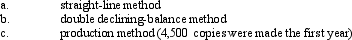

A copy machine acquired with a cost of $1,410 has an estimated useful life of 4 years. It is also expected to have a useful operating life of 13,350 copies. Assuming that it will have a residual value of $75, determine the depreciation for the first year by the

Correct Answer:

Verified

_TB2085_00_TB2085_00 b. Double...

_TB2085_00_TB2085_00 b. Double...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q38: The amount of depreciation expense for a

Q61: A fixed asset with a cost of

Q64: The formula for depreciable cost is<br>A) initial

Q86: As a company records depreciation expense for

Q120: The journal entry for recording an operating

Q137: The term applied to the amount of

Q141: Computer equipment (office equipment) purchased 6 1/2

Q143: Prepare the following journal entries and calculations:<br>

Q148: On July 1, 2010, Howard Co. acquired

Q167: Factors contributing to a decline in the