Essay

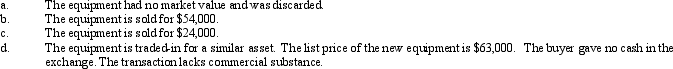

Equipment acquired at a cost of $126,000 has a book value of $42,000. Journalize the disposal of the equipment under the following independent assumptions. Journal

Journal

Correct Answer:

Verified

_TB2085_0...

_TB2085_0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q3: An intangible asset is one that has

Q23: The book value of a fixed asset

Q38: The amount of depreciation expense for a

Q55: When a company replaces a component of

Q61: A fixed asset with a cost of

Q64: The formula for depreciable cost is<br>A) initial

Q77: Residual value is also known as all

Q85: A double-declining balance rate for calculating depreciation

Q141: Computer equipment (office equipment) purchased 6 1/2

Q143: Prepare the following journal entries and calculations:<br>