Essay

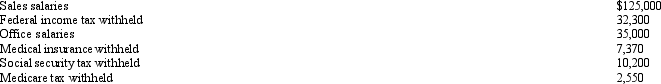

The summary of the payroll for the monthly pay period ending July 15 indicated the following:

Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $25,000 of salaries are subject to unemployment taxes.

Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $25,000 of salaries are subject to unemployment taxes.

Correct Answer:

Verified

(a)

_TB2085_00_TB20...

_TB2085_00_TB20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following is an example

Q10: A pension plan which requires the employer

Q15: Assuming no employees are subject to ceilings

Q22: A borrower has two alternatives for a

Q94: The amount of money a borrower receives

Q107: Taxes deducted from an employee's earnings to

Q154: For an interest bearing note payable, the

Q156: The journal entry a company uses to

Q187: Federal income taxes withheld increase the employer's

Q190: One of the more popular defined contribution