Essay

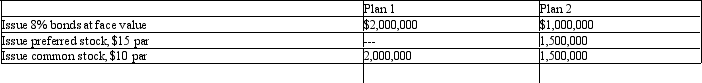

Ulmer Company is considering the following alternative financing plans:

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Income tax is estimated at 35% of income. Dividends of $1 per share were declared and paid on the preferred stock.

Required: Determine the earnings per share of common stock, assuming income before bond interest and income tax is $600,000.

Correct Answer:

Verified

_TB2085_00...

_TB2085_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: If sinking fund cash is used to

Q39: A bond is usually divided into a

Q40: When the effective interest method is used,

Q55: If bonds payable are not callable, the

Q60: A bond is simply a form of

Q91: When callable bonds are redeemed below carrying

Q101: The amount of interest expense reported on

Q129: The journal entry a company records for

Q135: If the market rate of interest is

Q165: Numbers of times interest charges earned is