Multiple Choice

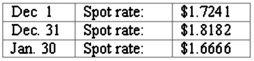

Norton Co., a U.S. corporation, sold inventory on December 1, 2011, with payment of 10,000 British pounds to be received in sixty days. The pertinent exchange rates were as follows:  What amount of foreign exchange gain or loss should be recorded on January 30?

What amount of foreign exchange gain or loss should be recorded on January 30?

A) $1,516 gain.

B) $1,516 loss.

C) $575 loss.

D) $500 loss.

E) $500 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q19: On March 1, 2011, Mattie Company received

Q20: Parker Corp., a U.S. company, had the

Q21: On December 1, 2011, Keenan Company, a

Q22: On October 1, 2011, Eagle Company forecasts

Q24: On December 1, 2011, Joseph Company, a

Q25: On April 1, 2010, Shannon Company, a

Q26: Car Corp. (a U.S.-based company) sold parts

Q27: On April 1, 2010, Shannon Company, a

Q72: What factors create a foreign exchange gain?

Q100: A U.S. company buys merchandise from a