Multiple Choice

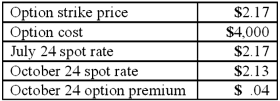

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24. On July 24, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October. The following exchange rates apply:  What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

What amount will Woolsey include as Adjustment to Net Income for the period ended October 31?

A) $6,000 positive.

B) $6,000 negative.

C) $10,000 positive.

D) $10,000 negative.

E) $14,000 positive.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: All of the following hedges are used

Q79: Frankfurter Company, a U.S. company, had a

Q80: Pigskin Co., a U.S. corporation, sold inventory

Q81: On December 1, 2011, Keenan Company, a

Q82: Parker Corp., a U.S. company, had the

Q83: Car Corp. (a U.S.-based company) sold parts

Q84: On June 1, CamCo received a signed

Q87: Coyote Corp. (a U.S. company in Texas)

Q90: How does a foreign currency forward contract

Q103: What happens when a U.S. company sells